Entry into force of the new EMCS system - Impact on Ship Supply

A guest commentary from Mr. Fernando Alves Pinto - Shipsupplier from Portugal

Mr.

Fernando Alves Pinto, Member of OCEAN's Working Group on customs & taxation comments on the entry into force of the new EMCS system and the impact on Ship Supply.

The Ship Supply industry is largely affected by today's entry into force of the new electronic system for monitoring and controlling the movement of excise goods (alcohol, tobacco and energy products).

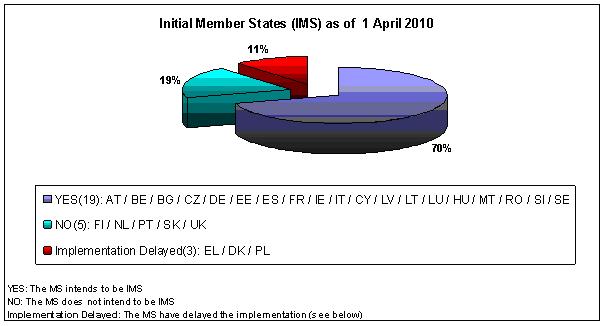

Allow me to recall that EMCS is designed to replace the current paper-based system, the EMCS is a computerised structure for recording in real-time the movement of products for which excise duties have still to be paid. However, Member States' authorities and economic operators can join the system progressively until 1 January 2011, after which the EMCS is excpected tobe fully applied throughout Europe. The question must be allowed how EMCS will function in a harmonised way until then. Are we sure that all my electronic messages I send from one country can also be read in another? If not, I'll have to rely on paper again - but is this still accepted in a fully computerised country?

Under EU legislation, excise duties must be paid on alcohol, tobacco and energy products at the final point before consumption. For Ship Supply, this is the vessel which brings the goods out of the EU. In any case, once delivered onboard as Ship Supply, they never touch EU ground again, regardless where the vessel goes next. While these goods are on their way to be delivered to the vessel, they are in transit to their final destination (the vessel which effectively acts as a third country) and no excise duty has yet been paid on them, so I understand that Member States need a system of monitoring their movement to ensure that the duties are properly levied at the final destination.

Until today, a paper-based system is applied, whereby I complete an "Accompanying Administrative Document" (ADD) which travels with the goods to the vessel. Once the consignment arrives at the vessel, the captain or ship manager or owner must acknowledge its receipt through the paper-based procedure.

Going online with difficulties for Ship Suppliers

The EMCS will now replace the paper AAD with an electronic record – the e-AD. This e-AD is sent electronically by the consignor (Ship Supplier) , via the EMCS systems in the Member States of dispatch and destination. When the goods arrive, the recipient files an electronic report of receipt, which is sent to the consignor who can then discharge the movement. At least so far for the theory!

For our specific trade, Ship Supply, the only way to make EMCS work for our industry is to obtain the exit confirmation message under the ECS customs system. For this to happen, it has to be clarified that Ship Supply means export and the export procedure is to be used when delivering excise goods onboard of vessels.

Let me be clear. I and all my collegues in OCEAN support modernization of customs and taxation procedures. Nevertheless, the procedures and system put in place must be workable for all economic operators in the EU, including Ship Suppliers. However, it is important to stress that for EMCS, the proper interaction with the ECS system to certify exit is now a necessity in order for Ship Supply to operate in the 21st century.

To close, allow me to point out that tax and duty free ship supply are fundamental for European Ship Suppliers and must be maintained.

What European Ship Suppliers need is direct recognition in EU law of our

• Exemption to pay VAT and

• Exemption to pay excise duties

In addition I strongly believe that a proposal must be made by the EU Commission to the Council of Ministers to implement Article 41 of COUNCIL DIRECTIVE 2008/118/EC, therefore renewing efforts for the development of only 1 clear excise regime in the European Union for Ship Supply.

This articles allows the Member States to keep their national rules and regulations for the supply of vessels as long as the Council, acting upon a proposal from the Commission, adopts Community rules on this matter. OCEAN knows that this results in at least 27 different regulations for the supply of vessels and decisions should be made to develop one European procedure for supplying ships with European excise goods under duty suspension.

Let's make EMCS a success for all stakeholders. OCEAN is ready to play its part.

Fernando Alves Pinto