VAT & Excise legislation

More on VAT

-

Blog Entry: "Zoom in on EU Value Added Tax - What is it, and why does it matter for EU ship supply?"

-

Blog Entry: "The new Italian VAT reporting system for ship stores - What's at stake for Italian ship suppliers?"

-

General Assembly ANPAN 30.04.2010: OCEAN Presentation, ANPAN VAT Presentation, Italian VAT Presentation

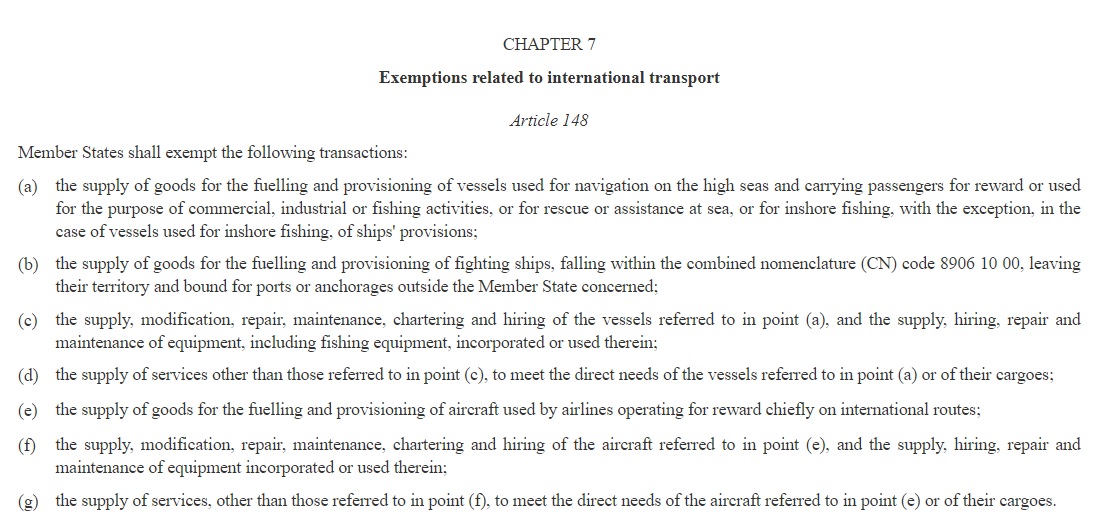

EU Excise Duty

EU excise duty rules cover the following products: Alcohol, alcoholic drinks, energy products, electricity, and tobacco products. There are reduced rates and exemptions available, such as duty-free purchases. This includes delivery to vessels as ship stores, as per COUNCIL DIRECTIVE (EU) 2020/262 of 19 December 2019 lays down the general arrangements for excise duty (as amended). the law harmonises the conditions for charging excise duty to ensure the proper functioning of the EU internal market. The formalities at the end of a movement of goods being exported (Article 25) are of particular relevance for ship stores, as are the alternative proofs of receipt and evidence of exit of Article 28. However, non remains more important than Article 49 "Stores for boats and aircraft", which states:"Until the Council has adopted Union provisions on stores for boats and aircraft, Member States may maintain their national provisions concerning exemptions for such stores". As a result, EU Member States decide the rules for excise goods for ship stores, leading to divergence among EU Member States.

More on Excise duty

-

Blog Entry: "A drink after a hard days' work - Challenging times ahead to supply favourite drinks and smokes on vessels". Read the essay of Eugenio Mediavilla, who discusses why national excise law impacts global crew and vessels consumption choice